Financially Sound

Effortless and speedy, accessible from any location. Only one document required

Effortless and speedy, accessible from any location. Only one document required

Rely on our direct lending for security and innovation. Your data is protected, and we offer solutions when you need them

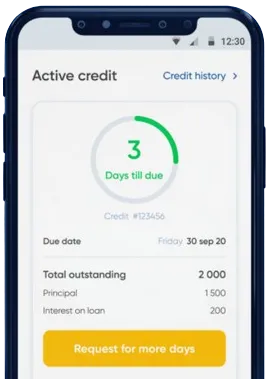

Quick and simple, without the hassle. Instant fund transfers with extended loan options

Enter your application details in the app by filling out the form.

Wait briefly for our decision, typically 15 minutes.

Access your funds; the process usually takes just a minute.

Enter your application details in the app by filling out the form.

Download loan app

Flypay loan is a trusted financial service provider in Nigeria that offers quick and convenient loans to individuals in need of financial assistance. With a simple and efficient application process, Flypay loan has become a popular choice for many Nigerians seeking to borrow money for various purposes.

One of the key benefits of Flypay loan is its fast approval process. Unlike traditional banks that may take days or even weeks to process loan applications, Flypay loan offers instant approval, allowing borrowers to access funds quickly when they need it the most.

Additionally, Flypay loan does not require collateral, making it accessible to a wider range of individuals who may not have assets to secure a loan. This feature makes Flypay loan a viable option for those who need urgent financial assistance but do not have valuable assets to offer as security.

Furthermore, Flypay loan offers flexible repayment options, allowing borrowers to choose a repayment plan that suits their financial situation. This flexibility gives borrowers peace of mind knowing that they can repay the loan without putting a strain on their finances.

Flypay loan is useful for a variety of purposes, including emergency expenses, debt consolidation, education fees, medical bills, and more. Whether an individual needs to cover unexpected costs or fund a personal project, Flypay loan provides a reliable source of financial support.

Moreover, Flypay loan can help individuals improve their credit score by making timely repayments. By borrowing responsibly and repaying the loan on time, borrowers can demonstrate their creditworthiness and build a positive credit history, which can be beneficial for future loan applications.

For those who need quick access to funds without the hassle of a lengthy application process, Flypay loan is a convenient solution that offers peace of mind and financial stability during challenging times.

In conclusion, Flypay loan in Nigeria offers a range of benefits and usefulness for individuals in need of financial assistance. With its fast approval process, no collateral requirement, flexible repayment options, and accessibility to a wider range of borrowers, Flypay loan stands out as a reliable and convenient financial service provider in the country. Whether you need to cover emergency expenses or fund a personal project, Flypay loan can provide the support you need, helping you achieve your financial goals with ease.

Flypay loan is a convenient and easy-to-access loan service offered in Nigeria by Flypay. It allows individuals to borrow money for various purposes, such as emergencies, bills, or personal needs.

To apply for a flypay loan, you can simply visit their website or download the Flypay app on your smartphone. Fill out the necessary information and follow the instructions provided to complete the application process.

The requirements for obtaining a flypay loan may vary, but typically include being a Nigerian citizen or resident, having a steady source of income, being of legal age, and having a valid bank account.

Once your flypay loan is approved, you can typically receive the funds within hours or by the next business day. The speed of disbursement may depend on various factors, such as your bank's processing time.

The repayment terms for a flypay loan may vary, but generally, you will be required to repay the loan amount along with any interest within a specified period, usually ranging from a few weeks to months.

Yes, there is typically a limit to how much you can borrow with a flypay loan. The exact limit may depend on various factors, such as your creditworthiness, income level, and the lender's policies.